GA4: Maximizing Digital Marketing Efforts with Google Analytics 4 for Banks and Credit Unions

- May 6, 2023

- Blog, Credit Union Marketing

The Retirement of Universal Analytics and The Arrival of Google Analytics 4 for Banks and Credit Unions

It’s official: Universal Analytics is set to retire on July 1, 2023. That means if you’re still using Universal Analytics, you need to switch to Google Analytics 4 (GA4) before that date.

Why switch to GA4? For starters, it offers a stronger analytics experience and the flexibility to measure various types of data. Plus, it bridges the gap between a customer’s journey from the website into 3rd party apps like Terafina, Blend and Meridanlink. And with Google’s machine learning AI, you’ll get insights on user behavior and conversions that you can’t get anywhere else. In other words, it’s the future of web analytics.

But that’s not all. GA4 offers some critical differences compared to Universal Analytics. For example, GA4 has more robust data protection and privacy controls, which are crucial in the age of data privacy regulations like GDPR and CCPA. Plus, it provides more advanced cross-device tracking capabilities, allowing you to understand the customer journey across multiple devices and touchpoints. And with built-in machine-learning algorithms, GA4 can automatically identify trends, generate insights, and provide recommendations.

Critical differences between Universal Analytics and GA4:

Data Privacy

With data privacy regulations like GDPR and CCPA becoming increasingly important, GA4 offers more robust data protection and privacy controls that are crucial for financial institutions and their members. These controls help banks and credit unions to comply with privacy regulations, safeguard their members’ data, and maintain their trust.

Cross-device Tracking

With GA4, financial marketers can gain more comprehensive cross-device tracking capabilities for both websites and apps, providing a better understanding of the customer journey across various touchpoints and devices. This helps businesses to create more effective marketing strategies that optimize customer engagement and increase conversions.

Machine-Learning

GA4 includes built-in machine-learning algorithms that automatically identify trends, generate insights, and provide recommendations.

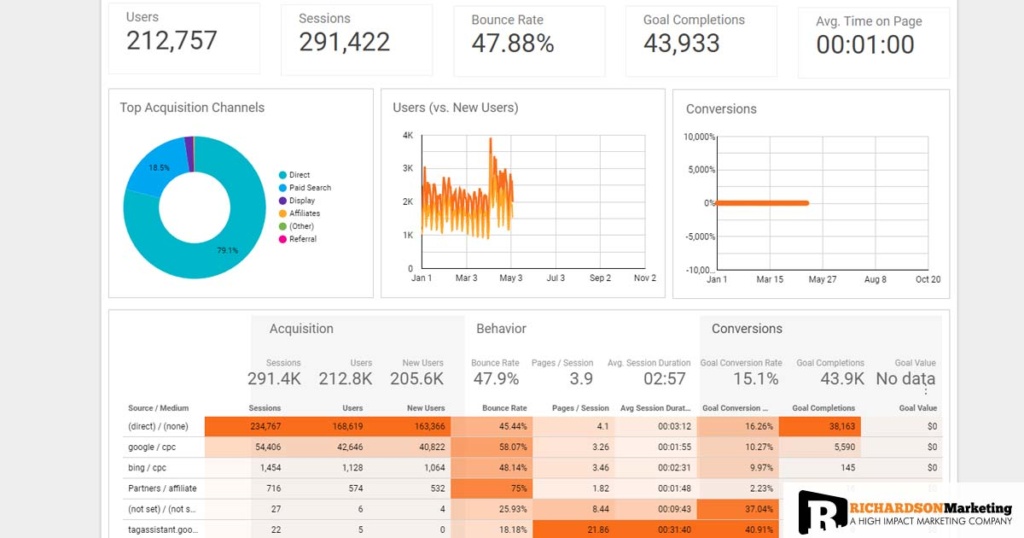

Bounce Rate

The definition of a bounce in GA4 is different from Universal Analytics. If a user visits your website, reviews content on your homepage for less than 10 seconds, and then leaves without triggering any events or visiting any other pages or screens, it counts as a bounce. You can increase the conditions from 10 seconds to 30 seconds or 60 seconds.

Goals

Say goodbye to goals and hello to “Conversion Events” in GA4! This new feature enables you to track a wider range of actions and get more in-depth insights into how customers interact with your website or app. Plus, you can create custom Conversion Events to track specific actions that are important to your business. With this level of customization, you can truly understand the customer journey and optimize for success!

By tracking important actions on your website or app as conversions, you’ll have a better understanding of what’s working and what’s not. And with GA4’s real-time reporting functions, you won’t have to worry about gaps in your data. Even if cookies or other identifiers aren’t available, GA4’s machine learning capabilities will fill in the gaps for you. So you can make data-driven decisions with confidence and improve your business’s performance online.

Behavioral Modeling

No more gaps in your data with GA4! Its machine learning algorithms fill in the missing pieces of the puzzle, providing you with real-time reporting functions even if cookies or other identifiers aren’t available. You can count on GA4 to deliver accurate and reliable data to help you make informed decisions for your bank or credit union.

Custom Channel Grouping

You can custom-select specific channels and compare their aggregated performance.

The creation of GA4 is Google’s shift to a “privacy-first” approach to cross-channel data tracking. The goal is to focus on the user and their journey.

With GA4, marketers can track users across websites, software, and apps. GA4 runs on a user-based model that collects data in the form of events. In fact, GA4 automatically tracks a host of events to fulfill the essential reporting requirements of the platform.

So what does all of this mean for you as a bank or credit union marketer? It means that GA4 is the future of web analytics, and it’s time to start the migration process from Universal Analytics to GA4. With powerful features that provide a comprehensive view of user behavior across devices and platforms, GA4 is the key to staying ahead of the curve and optimizing for the customer journey. So don’t wait – make the switch to GA4 today and start enjoying the enhanced analytics experience with advanced tracking and predictive data.

Benefits of Google Analytics 4 for Banks and Credit Unions

Now that you have an idea of how Google Analytics 4 works, let’s talk about some of the benefits of implementing it on your customer facing website, loan applications and deposit applications.

Google positions it as a tool to help improve marketing Return on Investment (ROI) in the long run. They say that GA4 enables marketers to uncover actionable insights that are privacy-safe for the entire customer journey.

- Discover the complete story of your customers’ journey with GA4, revealing a 360-degree view of their entire life cycle, without relying on paid cross-channel attribution.

- Connect the dots between your website and app with GA4’s ability to bridge the gap between data sources.

- Say goodbye to third-party cookies and track user data with or without identifiers to eliminate gaps in your data, giving you a comprehensive view of your audience.

- Collect more granular and accurate information with GA4’s elimination of cookie dependency, providing a clearer picture of your users.

- Predict your audience’s behavior with GA4’s AI-driven technology, helping you identify high-converting audiences with ease.

- Measure the true value of each ad click with new data attribution, providing you with a better understanding of your customer’s interactions with your paid ads.

- Gain deeper insights into your user’s journey with GA4, providing you with a comprehensive understanding of your user’s experience.

- Social Media and Ad Buy data integrations and imports.

- Stronger integrations with cross-platform tracking and third party applications like Terafina, Blend and Meridanlink LoandPQ

Improved Accuracy

GA4 uses a cutting-edge machine learning-based data model that reveals highly accurate and actionable insights. So, you can finally trust the data you’re working with is reliable and up-to-date, empowering you to make informed decisions that drive real results. No more guesswork or relying on inaccurate information. With GA4, you’ll have the insights you need to take your business to the next level!

Enhanced Data Privacy

With GA4’s enhanced data privacy and security features, you can have more control over your business data while ensuring your customers’ sensitive information is kept safe. Compliance with privacy regulations like GDPR has never been easier. GA4’s improved data privacy and security features can help your business maintain your customers’ trust and reputation, all while keeping your data secure.

Enhanced Cross-Device Tracking

With GA4, banks and credit unions can benefit from enhanced cross-device tracking capabilities, which enable them to gain a more complete understanding of their customers’ online journeys. This means that financial institutions can gain deeper insights into their customers’ preferences, behaviors, and needs, allowing them to make more informed decisions about how to engage with them. By tracking customers across multiple devices, banks and credit unions can get a more complete picture of their customers’ interactions with their brand, helping them to create more personalized and effective marketing campaigns.

Another benefit to banks and credit unions is the enhanced cross-device tracking capabilities to optimize their customer experience across different touchpoints. For example, they can use the data to improve the mobile banking experience, creating targeted advertising campaigns for customers on specific devices, and leveraging data from Terafina, Blend Meridanlink, LoandPQ and other third party applications. By leveraging the insights gained from cross-device tracking, banks and credit unions can deliver a seamless and personalized experience to their customers, which can ultimately lead to increased customer loyalty and retention.

More Advanced eCommerce Tracking

With GA4’s more advanced eCommerce tracking, banks and credit unions can easily measure the success of their online sales efforts. This allows for a deeper understanding of what’s working and what’s not, empowering data-driven decisions on how to improve their eCommerce strategy. With this level of visibility, financial institutions can adapt and optimize their online presence to drive more conversions and revenue.

Unleash the Full Potential of GA4 with GTM Integration: Simplify Tracking and Supercharge Your Marketing Strategy

In addition to using GA4, it’s also important to consider implementing Google Tag Manager (GTM) alongside it. GTM is a tool that allows you to add and manage tracking tags and pixels to your website without having to manually edit the code. This can save you time and make it easier to implement GA4 tracking on your site.

By using GTM with GA4, you can take advantage of advanced features like events, custom dimensions, and enhanced eCommerce tracking. This can help you get even deeper insights into your customers’ behavior and make more informed decisions about your marketing strategies.

At Richardson Marketing, our team of experts can help you set up and configure GTM and GA4 to work seamlessly together, ensuring that you’re getting the most out of both tools. We can help you implement custom tracking tags, set up advanced event tracking, and provide ongoing support and maintenance to ensure that your tracking is always up to date and accurate.

Take Your Bank/Credit Union’s Analytics to the Next Level with Richardson Marketing

Looking to take advantage of the benefits of Google Analytics 4 for your bank or credit union? Look no further than Richardson Marketing. Our team of digital marketing experts has the knowledge and expertise to help you implement GA4 and unlock its full potential.

At Richardson Marketing, we understand the unique needs of financial institutions and can help you leverage GA4 to improve your marketing ROI, gain deeper insights into your users and their journey, and enhance data privacy and security. With our guidance, you can make data-driven decisions with confidence, knowing that the insights you’re working with are accurate and up-to-date. Don’t wait any longer to take advantage of the benefits of GA4 – contact Richardson Marketing today to learn how we can help you improve your marketing efforts and drive growth for your bank or credit union. Feel free to reach out to us for a no obligation consultation!

About us and this blog

We are a full-service marketing company with a focus on helping our customers increase leads, sales, and conversions.

Request a free quote

Richardson Marketing is dedicated to helping our clients attract customers and increase sales.